Dive Transient:

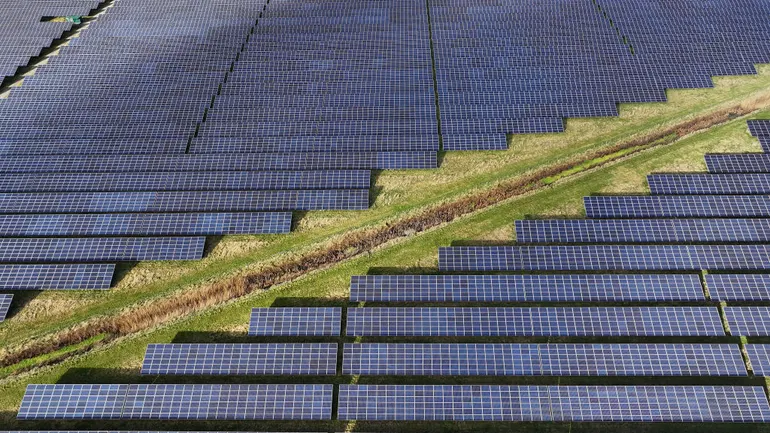

- The Senate Finance Committee on Monday released its version of the budget bill the Home handed in Could, providing gentler cuts to the Inflation Discount Act however nonetheless slashing tax incentives, particularly these for wind and photo voltaic vitality.

- The invoice permits transferability for the total lifetime of sure IRA vitality tax credit, breaking with the Home, which proposed ending transferability for 45Q, 45Z and 45X tax credit after 2027.

- The Senate proposal is especially powerful on residential photo voltaic and residential batteries, proposing that the 30% 25D tax credit score for these gadgets be phased out simply 180 days after President Donald Trump indicators the price range into legislation.

Dive Perception:

The Senate proposal removes the House’s tough requirement that initiatives should break floor inside 60 days of the invoice’s signing after which be positioned in service by the tip of 2028 to qualify for technology-neutral clear electrical energy manufacturing and funding tax credit.

The Senate model stipulates that eligible applied sciences akin to nuclear, geothermal and hydropower can declare the 45Y and 48E tax credit so long as they start building by 2033. Nevertheless, it topics wind and photo voltaic vitality to completely different guidelines.

Wind and photo voltaic initiatives would be capable of qualify for 60% of those credit in the event that they break floor by 2026, 20% in the event that they break floor by 2027, and nothing after that.

“For wind and photo voltaic, you might have notably large-scale initiatives which can be very a lot in improvement,” mentioned Harry Godfrey, who leads Superior Vitality United’s federal coverage crew. “They’re in interconnection. They’re in allowing processes which have pilot agreements, however they’re doubtless to not go to building till ’27 or ’28, so this successfully kills these initiatives.”

Godfrey mentioned the laws’s leasing prohibition on third-party wind and photo voltaic initiatives, together with the abrupt termination of 25D, hits the residential photo voltaic sector “from a number of angles.”

“Producers are telling me, ‘I do not know whether or not I [will] preserve manufacturing within the U.S. if I haven’t got a sure diploma of certainty about that demand, or a minimum of sufficient time to have the ability to transition accordingly’,” he mentioned.

Funding financial institution Jefferies mentioned in a Monday analysis notice, “Total, we view [the] Senate’s model as a destructive for [Sunrun, SolarEdge Technologies, and Enphase Energy,] however do notice the potential for storage to nonetheless be eligible for 48E below lease … We view the Senate’s model of adjustments to IRA as modestly optimistic with part out reintroduced for 48E/45Y. Storage totally unphased out: glorious final result for [NextEra Energy].”

Godfrey mentioned he was inspired to see the Senate transfer away from the “positioned in service” requirement to a “start building” requirement, although he famous that the strict timelines for wind and photo voltaic initiatives stay a problem. He mentioned he additionally was inspired to see a “broader utility of transferability throughout these credit.”

The Senate additionally moved to protect the unique timelines for the 45Q carbon sequestration and 45X superior manufacturing credit; the Home had voted to sundown these credit after 2028. Nevertheless, the Senate aligned with the Home in electing to finish the eligibility of wind elements for 45X after 2027.

Addressing international entity of concern restrictions, one other facet of the Home invoice that obtained criticism from the clear vitality sector, Crux, a finance expertise firm that connects tax credit score patrons and sellers, noted in a release that the Senate invoice “takes a basically completely different method from the Home … on [foreign entity of concern] restrictions. It introduces a cloth help value ratio framework — modeled off of the prevailing home content material bonus construction — that creates a credit-specific framework for qualification primarily based on the extent of non-FEOC enter sourcing throughout expertise classes.”

Crux mentioned that “preliminary reactions to the Senate language largely see it as clearer and extra workable than the Home FEOC provision, nevertheless it nonetheless will introduce a cloth, novel compliance burden that would basically constrict the variety of qualifying initiatives throughout the credit … This provision will face shut scrutiny within the coming days.”

Godfrey mentioned he “doesn’t assume this cake is baked but” — he nonetheless sees room for motion on sure points as this invoice strikes by the Senate.

“Undertaking builders, if they’ve a venture on-line the place they assume that this creates uncertainty and imperils their venture, needs to be calling their [representatives] and making it abundantly clear what’s at stake right here,” he mentioned. “We have actually heard receptivity [in the Senate] … I believe there are the numbers there to maneuver this in the fitting course.”

Trending Merchandise

CRAFTSMAN Pliers, 8 & 10″, 2Piece Groove Joint Set (CMHT82547)

TT TRSMIMA Safety Harness Fall Protection Upgrade 4 Quick Buckles Construction Full Body Harness 6 Adjustment D-ring

BIC Wite-Out Brand EZ Correct Correction Tape, 19.8 Feet, 4-Count Pack of White Correction Tape, Fast, Clean and Easy to Use Tear-Resistant Tape Office or School Supplies

![KwikSafety – Charlotte, NC – TSUNAMI KIT [Premium BRAIDED ROPE] Vertical Lifeline, 1-D Ring Safety Harness, Lightweight Tool Lanyard, Roof Anchor, 20L Dry Bag ANSI OSHA Fall Protection System / 50 FT.](https://m.media-amazon.com/images/I/51inmgg4jlL._SS300_.jpg)