Election jitters are affecting building exercise, although public sector initiatives proceed transferring forward, at the very least for now.

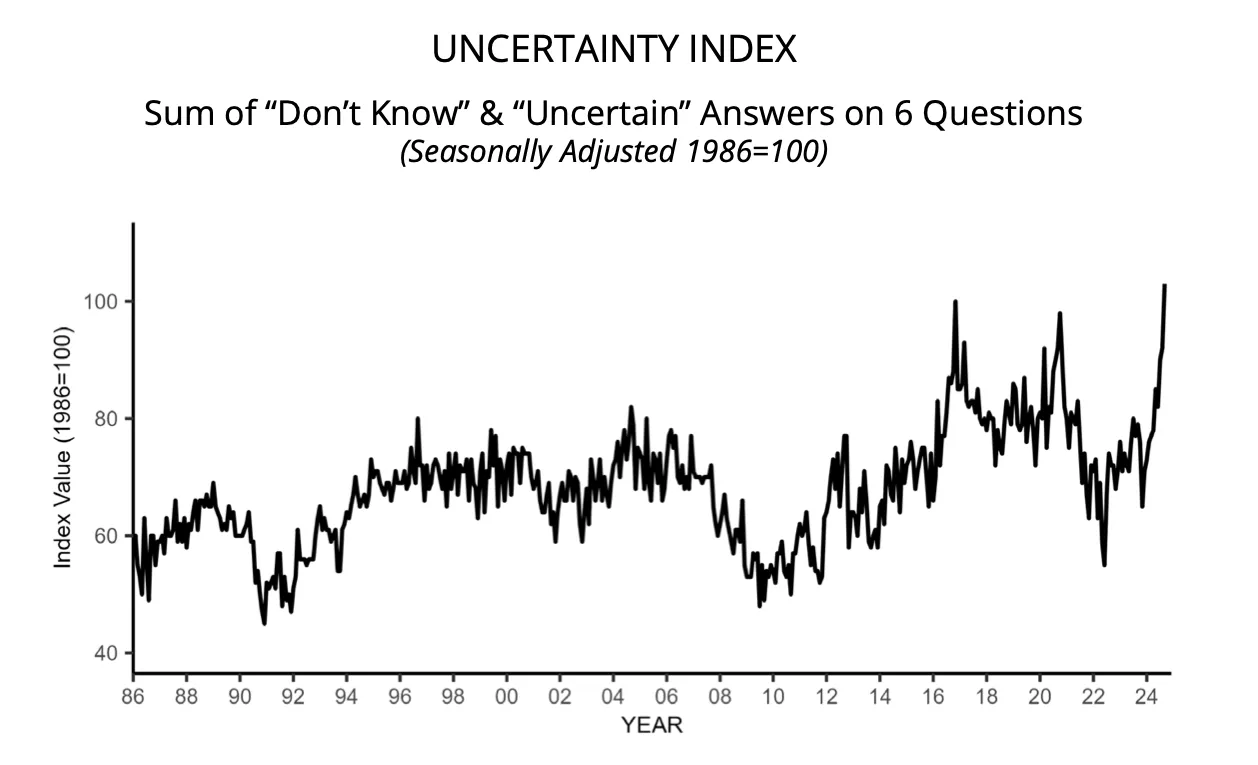

Uncertainty amongst small enterprise house owners throughout all industries lately reached an all-time high, based on the most recent index from the Nationwide Federation of Unbiased Enterprise, a commerce group representing smaller corporations. This anxiousness, coming throughout one of many tightest presidential contests in latest reminiscence, is affecting general constructing exercise, business professionals instructed Development Dive.

Courtesy of Nationwide Federation of Unbiased Enterprise

“We’re noticing uncertainty out there across the attainable financial impacts of the election,” mentioned Granger Hassmann, vice chairman of preconstruction and estimating at Adolfson & Peterson, a Minneapolis-based building administration agency. “The market usually appears to have slowed down, particularly within the non-public sector.”

And whereas the diploma of uncertainty has elevated in latest months, Hassmann added that the pattern has been obvious for the final two years, with the slowdown exacerbated by a “let’s see what occurs angle,” he mentioned.

Granger Hassmann

Courtesy of Adolfson & Peterson

In the meantime, within the Fed’s newest Beige E book report, which supplies commentary on present financial situations, the Federal Reserve Bank of Cleveland famous that two unnamed business builders lately reported that many corporations plan to attend till after the final election to undertake building initiatives. Development companies in New York additionally reported that exercise there has declined at a reasonable tempo, based on the Federal Reserve Bank of New York.

Harbingers of building

Architectural companies, usually early indicators of future building exercise, have additionally famous a slowdown. Design corporations have been feeling this pinch because the upcoming election clouds anticipated financial restoration, mentioned Kermit Baker, chief economist at The American Institute of Architects.

“We anticipated with inflation considerations receding and rates of interest easing, {that a} restoration can be coming however it appears that evidently election uncertainty is inhibiting any anticipated restoration for the time being,” mentioned Baker. “[Architecture] companies pointed to the upcoming elections as a significant purpose for the anticipated weak spot within the second half of the yr.”

Kermit Baker

Permission granted by AIA

That hesitation could be seen in different areas, as effectively.

For instance, electrical automobile battery producer Ultium Cells recently paused its $2.6 billion factory in Lansing, Michigan, attributable to sluggish demand and excessive rates of interest. The corporate plans to renew the undertaking as soon as it has a clearer financial outlook, reflecting the broader wait-and-see technique referred to by Hassmann.

And in Philadelphia, actual property developer Shift Capital paused conversion work in August on the historic Beury Constructing attributable to lender financing points, with CEO Brian Murray noting that top rates of interest and lender warning have made banks cautious of committing to giant initiatives. That hesitation displays broader considerations across the financial surroundings, together with excessive rates of interest and regulatory uncertainties.

That lack of readability is fueling this cautious strategy, as numerous potential outcomes may create totally different coverage environments, mentioned Michael Guckes, chief economist at ConstructConnect, a Cincinnati-based building knowledge supplier.

Actual property developer Shift Capital paused work in August on the Beury Constructing in Philadelphia attributable to lender financing points.

Courtesy of Shift Capital

“This matter, usually, is difficult as a result of a lot is determined by who controls not simply the White Home but in addition Congress,” mentioned Guckes. “There are various ‘divided authorities’ situations which might see both candidate’s presidential plans typically thwarted by an opposing Congress.”

Public initiatives faring higher

An exception appears to be infrastructure initiatives and public sector work.

Ken Simonson

Courtesy of AGC

Most public building initiatives have a protracted lead time and create constructions which might be supposed for use for a few years, so many homeowners would probably not maintain off after getting designs, approvals and financing, mentioned Ken Simonson, chief economist on the Related Normal Contractors of America. AGC member companies haven’t reported uncertainty from the election as a purpose for house owners to carry off on public jobs, he mentioned.

“I believe public initiatives, [such as] infrastructure, colleges, public security, judicial, penal constructions, knowledge facilities, utility initiatives and plenty of manufacturing crops are particularly resistant to election uncertainty,” mentioned Simonson. “These occur to be the classes with one of the best prospects for 2025.”

Nonetheless, some funding packages, reminiscent of huge subsidies to producers prepared to put money into new home manufacturing capability and various vitality producers included within the CHIPS Act and Inflation Discount Act, could possibly be considerably reshaped by a change in administration, mentioned Anirban Basu, chief economist at Related Builders and Contractors.

“This seems very true within the vitality sector,” mentioned Basu. “Beneath one attainable state of affairs, subsidies to various vitality producers can be diminished, whereas help for extra conventional types of vitality can be extra supported.”

For instance, photo voltaic cell producer Meyer Burger lately shelved its $400 million plant project in Colorado attributable to monetary constraints tied to the Inflation Discount Act and an unsure financial surroundings. That decreased its potential debt financing and, consequently, its building funds.

Anirban Basu

Permission granted by ABC

Basu additionally famous broader financial tendencies impacting contractors.

As an illustration, though the price of building supplies is 39% increased than on the onset of the COVID-19 pandemic, costs have been steadier over the previous two years. Current declines in vitality costs have helped keep this pattern, however Basu warned {that a} potential renewal of commerce warfare, particularly involving tariffs on China, would probably end in increased building prices.

He added that trade-related inflationary pressures may place upward stress on rates of interest, one thing contractors have been desirous to see ease.

A return to excessive charges?

If one celebration positive aspects full management of the White Home and Congress, the influence on building can be extra substantial, mentioned Guckes.

A Trump presidency with a Republican sweep of Congress may result in heightened deficit spending, decrease company taxes and elevated tariffs. That will create a mixed-environment of near-term development with a possible second wave of inflation, mentioned Guckes.

Assuming the Federal Reserve resorts to its inflation-battling technique of 2022 and 2023, increased rates of interest can be employed as soon as once more to curb that inflation. These hikes would then profoundly influence the flexibility of householders and builders to finance new building once more, mentioned Guckes.

Michael Guckes

Courtesy of ConstructConnect

“A repeat of the 2022 rate of interest hikes in 2026 or 2027 would negatively influence building within the yr or years to comply with as was the case in 2023 and 2024,” mentioned Guckes. “ConstructConnect’s present expectation for 4% annualized building development in each 2027 and 2028 can be prone to vital downward revisions.”

Stricter rules?

In contrast, a Harris administration with Democratic management of Congress would probably keep away from aggressive near-term spending however may impose stricter environmental and labor rules. That might probably sluggish building exercise too, mentioned Guckes.

“We might anticipate a [Harris administration to have a] much less aggressive strategy to bolstering near-term development. This is able to permit the nation to keep away from the worst of the inflation considerations,” mentioned Guckes. “Heightened environmental and labor rules may sluggish the tempo of recent building whereas additionally rising prices.”

In both state of affairs, Guckes instructed that the business will quickly have readability to renew or revise plans based mostly on the final word final result after Election Day.

Trending Merchandise

CRAFTSMAN Pliers, 8 & 10″, 2Piece Groove Joint Set (CMHT82547)

TT TRSMIMA Safety Harness Fall Protection Upgrade 4 Quick Buckles Construction Full Body Harness 6 Adjustment D-ring

BIC Wite-Out Brand EZ Correct Correction Tape, 19.8 Feet, 4-Count Pack of White Correction Tape, Fast, Clean and Easy to Use Tear-Resistant Tape Office or School Supplies

![KwikSafety – Charlotte, NC – TSUNAMI KIT [Premium BRAIDED ROPE] Vertical Lifeline, 1-D Ring Safety Harness, Lightweight Tool Lanyard, Roof Anchor, 20L Dry Bag ANSI OSHA Fall Protection System / 50 FT.](https://m.media-amazon.com/images/I/51inmgg4jlL._SS300_.jpg)