Briefly:

- The development trade in 2025 skilled slower general development, however high-potential alternatives emerged in sectors like manufacturing, information facilities, sports activities and conference facilities, and airports.

- Mega initiatives (over $1 billion) surged, now representing a big share of nonresidential development begins and providing main development pathways for companies.

- Persistent challenges—together with rising labor prices, a shrinking workforce, and elevated materials costs—require companies to deal with price management and strategic useful resource allocation.

- To achieve 2026, development firms ought to goal development in increasing sectors and leverage trade information and assets to make knowledgeable, aggressive choices.

Success within the development trade is not nearly laborious work. It’s about making that onerous work depend. This implies combining your effort with a sensible technique. Chief Economist, Michael Guckes, shared crucial insights throughout the Bid Like a Boss: Methods to Energy Your 2026 Enterprise webinar that can assist you just do that. He explored the financial panorama, highlighted particular development tendencies, and provided a framework for subsequent steps.

We’ll unpack the largest takeaways from 2025 which might be key to setting your enterprise up for fulfillment in 2026. Use these takeaways as your roadmap for development and resilience within the new 12 months.

What’s the Financial Outlook for Development in 2026?

To make 2026 your finest 12 months but, you must perceive the broader financial setting. After two years of almost 3% development, the U.S. economic system is predicted to sluggish. Whereas this isn’t a recession, it alerts a shift away from the speedy growth we’ve seen in earlier years.

A number of components contribute to this slowdown:

- Slowing Inhabitants Progress: An extended-term development of slower inhabitants development immediately impacts consumption and, consequently, financial growth.

- Secure Curiosity Charges: The period of traditionally low rates of interest seems to be over. We anticipate charges will maintain roughly regular, that means the price of financing initiatives will stay a big consideration for the foreseeable future.

For contractors, this average financial setting signifies that alternatives for development can be extra focused. Probably the most profitable development companies will deal with figuring out and pursuing initiatives in sectors and markets with the best potential. Focused development, somewhat than broad growth, can be key to profiting from the alternatives that 2026 has to supply.

The place is the Progress Occurring within the Development Trade?

Whereas complete development begins have been up modestly final 12 months, the underlying story is a panorama of sharp contrasts between increasing and shrinking segments. Understanding the place the alternatives lie is step one towards sensible, strategic development in 2026.

Excessive-Progress Sectors

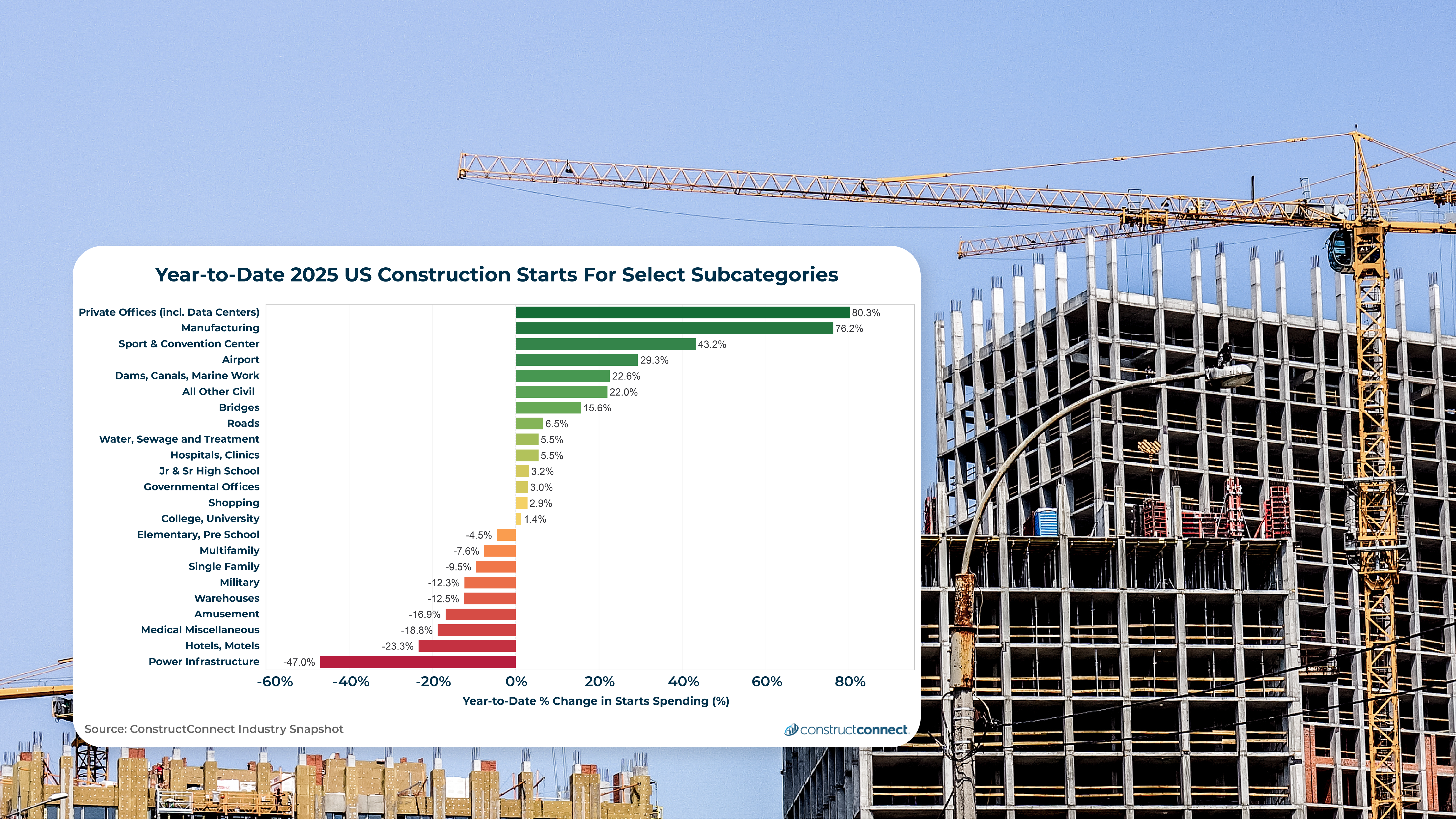

Our information tracks 33 totally different subcategories, and a transparent sample has emerged: about half are rising whereas the opposite half are contracting. This divergence underscores the significance of focusing your gross sales and advertising efforts the place momentum is the strongest. By directing assets towards increasing segments and avoiding shrinking sectors, you’ll maximize returns in your efforts and place your enterprise for larger success within the new 12 months.

The strongest development is going on in:

- Knowledge Facilities

- Manufacturing

- Sports activities & Conventions Facilities

- Airports

Classes like energy infrastructure, motels, and sure medical amenities are experiencing a contraction. The secret is to align your enterprise technique with the market’s momentum.

The Rise of Mega Initiatives Continues

One of the highly effective tendencies shaping the trade is the surge in mega initiatives—these valued at over one billion {dollars}. In 2025, mega mission spending rose by 47%, accounting for one in each 5 nonresidential begin {dollars}. It is a large enhance from 2022, when it was one in each ten.

These mega initiatives will not be evenly distributed. They’re closely concentrated in industrial, civil, and industrial development. As you progress into 2026, partaking with the momentum of mega initiatives can open substantial development pathways for your enterprise.

How Can Development Corporations Management Prices in 2026?

2025 tendencies make it clear that controlling prices is important for reaching profitability in 2026. Understanding market situations is simply a part of the equation. Your capability to actively handle prices—particularly with ongoing pressures in labor and supplies—will decide your aggressive edge and monetary outcomes within the 12 months forward. Two main components are creating main price pressures for development companies at the moment: labor and supplies.

The Labor Problem is Right here to Keep

The upward trajectory of wages seen in 2025—with year-over-year development holding regular above 4%—will proceed to form the development trade in 2026. That is pushed by a shrinking labor pool and elevated competitors for expert staff. The scenario is especially acute in development, which is extra delicate to the supply of foreign-born staff than some other trade. In keeping with current U.S. Census information, almost 34% of all development staff are international born. Surveys additionally present that roughly half of those staff are labeled as “unauthorized.” That places as a lot as 20% of your entire development workforce in danger if insurance policies change.

A possible discount within the accessible labor pressure will solely intensify the competitors for staff, not simply inside development however from different industries like agriculture and transportation. Defending your labor pressure can be one in every of your greatest challenges within the coming years.

Rising Materials Costs Affect Revenue Margins

The surge in materials costs throughout 2025—rising 5.2% year-over-year—could have a direct impression on mission margins as you progress into 2026. Elements like worldwide tariffs and evolving provide chain dynamics are contributing to this volatility. These value hikes can shortly erode mission margins, making correct price estimation and administration extra crucial than ever.

Steps for Smarter Selections in 2026

Crucial step you have to take as you enter 2026 is translating the teachings and insights gained from 2025 into motion that units your enterprise aside within the new 12 months. By making use of what you’ve realized about market dynamics and price administration, you’ll be higher outfitted to not solely navigate challenges, but additionally outpace rivals within the 12 months forward.

Leverage these free resources by ConstructConnect to remain forward of tendencies and make knowledgeable enterprise choices:

- Construction Economy Snapshot: For over 20 years, the Development Financial system Snapshot has tracked month-to-month begins and market tendencies, delivered with economist commentary and evaluation.

- Construction Starts Forecast: This quarterly report delivers a five-year development begins forecast, providing evaluation and insights grounded within the trade’s most complete mission information.

- ConstructConnect Expansion Index: Use the ConstructConnect Enlargement Index to get insights into trade development, demand forecasting, and useful resource planning, enabling higher bidding methods, monetary choices, and aggressive positioning.

- Project Stress Index: The Venture Stress Index is a rolling measure of preconstruction initiatives delayed, deserted, or positioned on maintain over the past 30 days. The Index is an early indicator of potential headwinds for the U.S. development market.

- ConstructConnect News: The premier information and financial supply for commerce contractors, constructing product producers, and common contractors in nonresidential development.

Take step one towards a extra strategic 2026. Discover our free financial assets at the moment to realize the readability and confidence you have to construct a stronger, extra resilient enterprise.

Trending Merchandise

CRAFTSMAN Pliers, 8 & 10″, 2Piece Groove Joint Set (CMHT82547)

TT TRSMIMA Safety Harness Fall Protection Upgrade 4 Quick Buckles Construction Full Body Harness 6 Adjustment D-ring

BIC Wite-Out Brand EZ Correct Correction Tape, 19.8 Feet, 4-Count Pack of White Correction Tape, Fast, Clean and Easy to Use Tear-Resistant Tape Office or School Supplies

![KwikSafety – Charlotte, NC – TSUNAMI KIT [Premium BRAIDED ROPE] Vertical Lifeline, 1-D Ring Safety Harness, Lightweight Tool Lanyard, Roof Anchor, 20L Dry Bag ANSI OSHA Fall Protection System / 50 FT.](https://m.media-amazon.com/images/I/51inmgg4jlL._SS300_.jpg)