The U.S. is spending extra on industrial development this yr, however economists view the outlook for 2025 with cautious optimism. That was the consensus throughout ConstructConnect®’s fall 2024 webinar, “The Construction Economy Outlook: 2025 Starts Now.”

A number of main economists provided their insights on the state of the business, together with Michael Guckes, ConstructConnect’s Chief Economist; Kermit Baker, Chief Economist for the American Institute of Architects (AIA); and Ken Simonson, Chief Economist for the Related Common Contractors of America (AGC). They have been additionally joined by Kristy O’Brien, ConstructConnect’s Director of Content material Acquisition.

Listed here are the highest 5 takeaways from the webinar.

-

Spending is up, however anticipated to sluggish in 2025

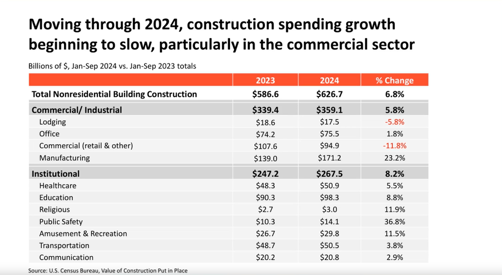

In accordance with numbers from america Census Bureau, non-residential industrial development spending has elevated by virtually 7% this yr in comparison with 2023. Baker says that is wholesome progress however predicts that month-by-month drops in spending imply we are going to actually shut the yr with a progress fee of about 5% to five.5%.

Spending is predicted to fall much more in 2025. Citing the newest AIA Consensus Construction Forecast Panel survey from July 2024, Baker says forecasters predict whole non-residential spending to develop solely 2% subsequent yr.

Whereas these are nonetheless technically will increase, Baker is fast to level out that they proceed to get smaller.

-

Manufacturing, warehouses, information facilities taking part in their position in 2024

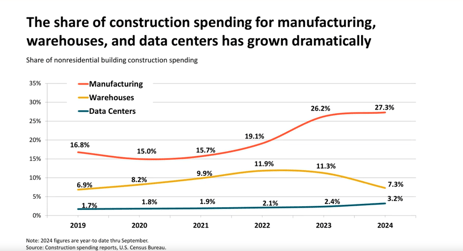

Baker says, “[Manufacturing, warehouses, and data center projects] have had an outsized affect on the tendencies we’re seeing within the non-residential constructing market.”

The Census Bureau reviews that spending on manufacturing tasks has grown by 23% in 2024.

A curious statistic is present in workplace development spending, which has risen by 1.8% this yr. Baker acknowledges that the workplace class is traditionally the weakest in industrial development. He says the famous enhance in spending is as a result of the Census Bureau considers information facilities part of the workplace class.

Information facilities are services housing laptop techniques and servers for information storage and processing. They proceed to be massive enterprise. In late November 2024, Meta introduced it might spend $5 billion on an information heart challenge in rural Louisiana.

With regards to all non-residential industrial development spending in 2024, the Census Bureau says:

- Information facilities make up 3% of all spending.

- Warehouse development has fallen from peak numbers in 2022 however nonetheless makes up 7% of spending.

- The manufacturing class continues to be the most important spending driver. Greater than 27% of all non-residential tasks this yr have been manufacturing.

-

Labor remains to be a combined bag

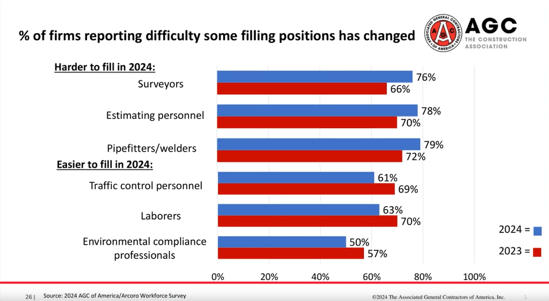

Labor shortages proceed to be a problem. A latest AGC survey discovered that greater than 90% of contractors report bother discovering each hourly and salaried positions. These figures have been within the 80% vary simply final yr.

Regardless of these figures, Simonson says employment in non-residential development is up almost 4% in 2024. That’s in line with the U.S. Bureau of Labor Statistics, which additionally says 40 states report a rise in development employment. Alaska, Hawaii, Oklahoma, Nevada, and Montana are the 5 states with the most important will increase.

Oregon reported the most important loss, with a 4% drop in development jobs. Maryland, Maine, Vermont, and New York full the underside 5 states.

“Nonetheless,” Simonson says, “contractors inform us that discovering employees remains to be their primary problem.”

He provides that the toughest roles to fill proceed to be skilled positions, resembling surveyors, estimators, pipefitters, and welders. Nevertheless, he does say companies have reported discovering it simpler this yr to fill entry-level positions, like site visitors management and basic labor.

“Individuals who shunned development as a result of they thought they may get an indoor job, maybe with versatile hours, [are now] discovering these aren’t so out there, or they’re not paying in addition to development. So, extra individuals are exhibiting as much as apply for entry-level development jobs,” Simonson theorizes.

-

Bidding is up within the U.S.

Bidding on U.S.-based development tasks rose by about 5% this yr, in line with information collected by O’Brien’s Content material Acquisition workforce at ConstructConnect. Her workforce collaborates with corporations, contractors, and different professionals to curate and confirm energetic and upcoming development tasks throughout North America.

The rise in bids signifies extra new tasks as properly. O’Brien notes that the U.S. is experiencing a 7% enhance in new development tasks in comparison with 2023’s numbers.

-

Anticipate to see extra accommodations, shops, and even navy tasks in 2025

Of the almost 30 several types of U.S. industrial development that ConstructConnect collects data on, Guckes says almost 75% are anticipated to expertise sturdy progress subsequent yr.

This progress is pushed by a predicted 56% enhance in navy challenge spending, an virtually 28% rise in lodge tasks, and a projected 25% enhance for purchasing and retail.

“A part of that’s only a turnaround story,” Guckes explains. “The navy sector actually struggled this yr, and accommodations and motels had an identical expertise. Some areas the place we noticed weaknesses in ’24 are anticipated to see sturdy rebounds in ’25.”

Conversely, some areas that skilled progress in 2024 will seemingly see declines in tasks subsequent yr, together with prisons and airports.

Wrapping up

The outlook for the U.S. development business in 2025 combines each optimism and warning. Whereas industrial development spending continues to develop, it should seemingly accomplish that at a slower fee subsequent yr. Regardless of a rise in entry-level development staffing, discovering skilled assist remains to be a problem. Nonetheless, corporations are bidding on extra tasks.

As is the case yearly, it will likely be vital for contractors and companies to maintain a eager eye on market components and tendencies in 2025. The excellent news is that ConstructConnect collects this info for you within the Economic Insights section of our website. Get free, up-to-date metrics, information, and reviews you received’t discover wherever else.

Trending Merchandise

CRAFTSMAN Pliers, 8 & 10″, 2Piece Groove Joint Set (CMHT82547)

TT TRSMIMA Safety Harness Fall Protection Upgrade 4 Quick Buckles Construction Full Body Harness 6 Adjustment D-ring

BIC Wite-Out Brand EZ Correct Correction Tape, 19.8 Feet, 4-Count Pack of White Correction Tape, Fast, Clean and Easy to Use Tear-Resistant Tape Office or School Supplies

![KwikSafety – Charlotte, NC – TSUNAMI KIT [Premium BRAIDED ROPE] Vertical Lifeline, 1-D Ring Safety Harness, Lightweight Tool Lanyard, Roof Anchor, 20L Dry Bag ANSI OSHA Fall Protection System / 50 FT.](https://m.media-amazon.com/images/I/51inmgg4jlL._SS300_.jpg)